Pakistan freelance policies 2025 are redefining how millions of Pakistanis work, earn, and connect with the global market. Unlike past years, these new policies are more than just minor tax tweaks — they are part of a larger strategy to transform Pakistan into a trusted hub for remote work and IT exports.

From updated SBP income reporting formats to tax exemptions and interest-free loans, Pakistan freelance policies 2025 aim to remove old barriers that freelancers faced for decades — like complex banking rules, double taxation, and informal cash flows. Today, freelancers, startups, and small IT exporters can tap into clearer frameworks, secure payments faster, and plan for long-term growth with confidence.

This matters more than ever because the global freelance economy is booming — and AI, automation, and remote-first tools are giving Pakistani freelancers unprecedented access to international projects. But only those who understand and adapt to these new policies will stay ahead.

In this detailed guide, we’ll break down exactly what’s changed under Pakistan freelance policies 2025, why these shifts are so significant, and the practical steps you can take right now to protect your income, stay compliant, and unlock new opportunities for remote work and digital exports.

Read also: Top 5 AI Tools for Small Businesses in 2025 – Work Smarter & Save Big

Table of Contents

A Quick Look Back: Why Policy Changes Were Needed

For years, Pakistan has ranked among the world’s top five freelance markets — with tens of thousands of professionals earning valuable foreign exchange for the country. Yet despite this, freelancers often struggled with confusing tax rules, tricky bank requirements, payment delays, and unclear government policies.

Freelancers sending money back home through Payoneer, PayPal (via third-party routes), or wire transfers often faced double taxation, bank compliance hurdles, or account freezes. Many operated informally, avoiding tax filings altogether — putting them at risk when trying to scale their business.

Recognizing this, the Pakistani government and State Bank of Pakistan (SBP) started rolling out targeted initiatives in 2023 and have accelerated them dramatically in 2024–2025.

Pakistan Freelance Policies 2025 — What’s New?

Here are some of the biggest shifts that are directly impacting remote work and freelancing this year:

1. Updated Foreign Income Reporting — The New ePRC & S-PRC

One of the biggest pain points for freelancers has been proving their foreign income to banks and tax authorities. Previously, the same income could show up under multiple categories, triggering double counting or unnecessary audits.

In June 2025, the SBP revised the Foreign Exchange Income Reporting Format — specifically the ePRC (Electronic Proceeds Realization Certificate) and S-PRC. These formats will now include clearer codes that match modern freelance income streams, IT exports, and digital services. From October 1, 2025, banks must adopt the new format, which means faster payments, cleaner records, and less chance of audits for legitimate freelancers.

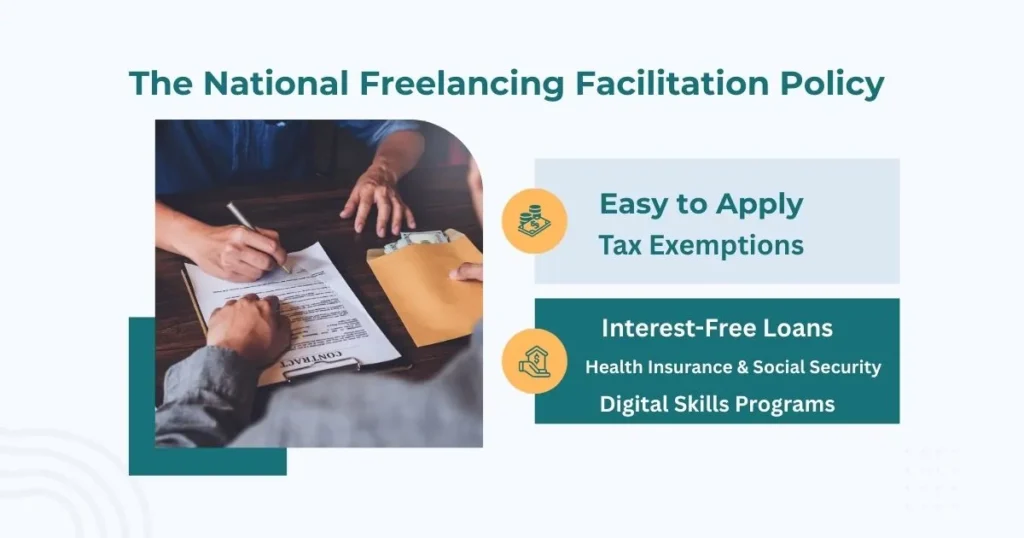

2. The National Freelancing Facilitation Policy

The Ministry of IT and Telecom’s National Freelancing Facilitation Policy (NFFP) has been gradually rolled out since 2023, but 2025 is the year it’s expected to fully click.

Key highlights include:

- Tax Exemptions: Registered freelancers earning up to a certain annual threshold can enjoy tax exemptions or simplified tax rates until 2030.

- Interest-Free Loans: Banks, in partnership with the government, are offering low-interest or interest-free loans for freelancers to buy equipment, set up small offices, or expand their teams.

- Health Insurance & Social Security: Pilot programs in major cities like Lahore, Karachi, and Islamabad are testing affordable freelancer health coverage and retirement plans.

- Digital Skills Programs: Initiatives like E-Rozgaar are expanding to more cities, helping thousands of young Pakistanis upskill for remote work.

3. Clarity on Tax & Compliance

Freelancers who once avoided the tax system entirely now have clear incentives to register:

- Separate Remittance Accounts: Freelancers can now open ESFCAs (Exporters’ Special Foreign Currency Accounts) or FDAs (Freelancer Digital Accounts) with simpler onboarding.

- Defined Tax Rates: A clear 0.25–1% tax on remittances means less fear of sudden back taxes or unexpected audits.

- Registration Drives: The Pakistan Software Export Board (PSEB) is actively helping freelancers register and get certified for incentives.

How These Policies Are Changing Remote Work in Real Life

So, what does this all mean for everyday freelancers and small tech startups?

1. Faster, Safer Payments

One of the worst bottlenecks for Pakistani freelancers has always been payment delays. Many rely on Payoneer or middlemen to receive foreign payments. With clearer banking frameworks and the new ePRC format, banks can process these payments faster and with fewer questions asked.

2. More Freelancers Going Legit

Tax incentives and compliance clarity are convincing more freelancers to “go formal.” That means more can apply for business visas, work with international clients confidently, or even hire small remote teams.

3. Startups Hiring Remote Talent Locally

Startups and SMEs in Pakistan can now hire local freelancers with more confidence. They can pay them easily, deduct taxes correctly, and comply with laws without worrying about complicated paperwork.

4. Women and Youth Getting More Access

Affordable internet, micro-loans for laptops, and home-based skill centers are making it easier for women and young people in second-tier cities to join the freelance economy. Initiatives like the E-Rozgaar program are targeting exactly this gap.

Real Numbers: Pakistan’s Freelance Economy in 2025

The results are already showing:

- In the first nine months of FY 2025, Pakistan’s IT and freelance remittances hit $400 million.

- The country is on track for over $2.7 billion in annual IT exports.

- The government’s target for FY 2029 is $25 billion — and freelancers are expected to contribute a significant slice.

These figures highlight just how critical the freelance economy is becoming — and why these new policies are so important.

Challenges That Remain

Of course, challenges remain. Many freelancers still don’t know how to register properly or are unsure about tax compliance. Some banks are slow to implement the new formats, especially in smaller cities. And digital payment options like PayPal still aren’t directly available.

What Freelancers Should Do Nex

If you’re freelancing in Pakistan, here’s how you can take advantage of these changes today:

Open a separate foreign currency account. This helps keep your freelance income clear and separated from your personal money.

Register with the Pakistan Software Export Board (PSEB). It’s free and opens the door to official incentives.

Understand your new tax obligations. The 0.25–1% tax is low, but you must file properly. Talk to a tax consultant if needed.

Stay updated. Join online communities, subscribe to IT Ministry updates, or follow the E-Rozgaar program for new training opportunities.

Promote your services more boldly. With better banking and policy support, you can approach bigger international clients and negotiate better rates.

What Employers & Startups Should Do

Hire more local freelance talent instead of relying solely on expensive full-time overseas teams.

Use official channels for payments to freelancers — this protects you legally.

Take advantage of low-interest loans to expand your tech capacity and export services.

Final Thoughts

Pakistan’s new freelance policies in 2025 represent one of the biggest shifts in South Asia’s remote work environment. If implemented well, they can unlock billions in foreign exchange, empower millions of young Pakistanis, and position Pakistan as a leading global freelancing hub.

As a freelancer, you hold a piece of this opportunity — but only if you adapt, stay informed, and make the most of these benefits.

What’s your experience with freelancing under these new policies? Are you facing any hurdles? Drop a comment below — let’s help each other thrive!

FAQs on How Pakistan’s New Freelance Policies Are Changing Remote Work in 2025

What is Pakistan’s new freelance policy for 2025?

Pakistan’s new freelance policy for 2025 includes updated foreign income reporting formats (ePRC and S‑PRC), clear tax exemption rules for freelancers, simplified banking for foreign remittances, and support programs like the National Freelancing Facilitation Policy. These changes aim to boost remote work and IT exports.

How do I open a foreign currency account for freelancing in Pakistan?

Freelancers in Pakistan can open an Exporters’ Special Foreign Currency Account (ESFCA) or Freelancer Digital Account (FDA) through authorized banks. These accounts help receive foreign freelance remittances under the new SBP freelance income reporting format.

Are freelancers in Pakistan tax exempt in 2025?

Under the National Freelancing Facilitation Policy, registered freelancers can enjoy tax exemptions up to a certain income threshold or pay a minimal 0.25%–1% tax on foreign remittance income, provided they comply with SBP and FBR guidelines.

What is ePRC for freelancers in Pakistan?

An ePRC (Electronic Proceeds Realization Certificate) is an official bank certificate that verifies a freelancer’s foreign income. In 2025, Pakistan’s State Bank introduced updated ePRC and S‑PRC formats to make freelance income reporting clearer and prevent double taxation.

How can freelancers in Pakistan get interest-free loans?

Through the National Freelancing Facilitation Policy, eligible freelancers can apply for low-interest or interest-free loans to upgrade equipment, expand their services, or set up small remote workspaces. Many banks now offer these loans with government support.

Is freelancing legal in Pakistan in 2025?

Yes! Freelancing is legal and officially supported in Pakistan. New 2025 freelance policies, tax rules, and SBP frameworks make it easier for freelancers to work with overseas clients, receive payments legally, and comply with tax and banking regulations.

How do I register as a freelancer with PSEB in Pakistan?

Freelancers can register with the Pakistan Software Export Board (PSEB) online. Registration helps them access tax incentives, freelancing training programs like E‑Rozgaar, and eligibility for export remittance benefits under the new policy.

Israr Ahmed is a technology educator and creator behind the YouTube channel “Israr Ahmed Technical,” where he shares practical IT, networking, cybersecurity, and software tutorials. He also runs DriveInTech.com and PakAider.pk to help learners and professionals grow in the digital world.